Ultimate Women Financial Tips for Your 30s, 40s, and 50s: Secure Your Financial Future Now

In today’s fast-paced and ever-evolving world, financial empowerment for women is more critical than ever. Whether you’re navigating your early 30s, embracing your 40s, or solidifying your foundation in your 50s, the right money management tips for women can significantly impact your financial future. We’ve curated a comprehensive guide tailored to each decade of a woman’s life to ensure stability, growth, and confidence in financial decision-making.“According to Forbes, building strong financial habits early in life lays the foundation for long-term wealth and security.”

💼 Women Financial Tips in Your 30s: Build the Foundation Early

1. Prioritize Emergency Savings

In your 30s, unexpected expenses such as job loss, health issues, or car repairs can worry our financial progress. For these Unexpected expenses, we need to build a robust emergency fund of at least 3–6 months’ worth of living expenses. You have to maintain a high-yield savings account to grow your safety net without risking loss.

2. Start Investing With a Few Dollars

Most of the Schemes will not ask for minimum requirements such as Mutual funds, Stocks, Post Office Monthly Investment Scheme. You need not be rich to start investing- you need to start to get rich. Far too many women delay investing due to risk aversion.

3. Master Budgeting Basics

Use a simple tool like a spreadsheet to track your income and expenses. Follow the 50/30/20 rule, where 50% needs, 30% wants, 20% savings, and debt repayment.

4. Eliminate High-Interest Debt

Prioritize on paying off credit cards and high-interest loans at the earliest. Use the avalanche method (paying off the highest interest rate first) or the snowball method (starting with the smallest balance for motivation).

5. Build Credit Wisely

Maintain a strong credit score by paying bills on time, keeping credit utilization below 30%, and reviewing your credit report annually. Good credit is essential for major life decisions like buying a home or financing a business.

💰 Smart Financial Moves for Women in Their 40s: Maximize and Strategize

1. Max Out Retirement Contributions

In your 40s, you are likely to be halfway through retirement planning. Consider working with a certified financial planner to tailor your retirement plan.

2. Diversify Income Streams

Side hustles, rental properties, dividend-paying stocks, or freelancing actively work on these type of income sources, which can generate extra income. Where you can start in multiple ways to achieve financial Independence.

3. Invest in Long-Term Assets

Long-term assets will give Big Profits beyond savings accounts. Explore investing in mutual funds, real estate, or a small business. Real estate is one of the best options that can serve both a retirement asset and a passive income source.

4. Plan for Your Children’s Education

If you have children, open a 529 college savings plan or education IRA. These accounts offer tax benefits and the chances of taking loans, interest will be decreased.

5. Reassess Insurance Needs

This is the time to review your life, health, disability, and home insurance policies. A sudden accident or any unexpected health issues could risk your financial stability without proper coverage

🏆 Financial Planning for Women in Their 50s: Protect and Preserve Wealth

1. Conduct a Full Retirement Readiness Review

Review your expected expenses, savings, pensions, Social Security benefits, and investment returns. Adjust your retirement contributions and consider delaying Social Security to maximize payouts.

2. Pay Off Remaining Debts

Clear any remaining mortgage, auto loans, or personal debts. Entering retirement debt-free provides peace of mind and increased financial flexibility.

3. Downsize and Optimize

Evaluate your housing and lifestyle needs. Downsizing your home or relocating can reduce expenses and free up capital for investing or travel.

4. Create a Legacy Plan

Work with an estate planning attorney to draft a will, durable power of attorney, healthcare directive, and establish trusts if needed. Protect your wealth and ensure your wishes are followed.

5. Consider Catch-Up Contributions

If you’re behind on retirement savings, take advantage of IRS catch-up contribution limits for those 50 and older. You can contribute extra to 401(k)s and IRAs to close the gap

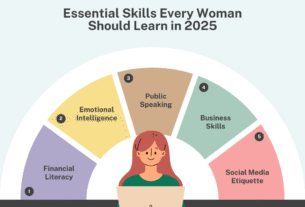

🧠 Timeless Money Management Tips for Women at Any Age

1. Stay Financially Educated

Subscribe to trusted financial newsletters, read books like Smart Women Finish Rich by David Bach, or follow female finance influencers. Staying informed is key to making confident decisions.

2. Build a Financial Support Network

Join groups or forums focused on women and money. Discussing finances with like-minded women fosters empowerment, accountability, and learning.

3. Track Your Expenditure and Create a Realistic Budget

Set up automatic transfers for savings, retirement contributions, and investment accounts. Automation makes wealth-building effortless and consistent.

4. Don’t Sacrifice Your Financial Goals for Others

Women often prioritize family needs over personal finance goals. Set clear boundaries and remember: you can’t pour from an empty cup. Your financial health is a long-term gift to your loved ones.

5. Regularly Review and Adjust Financial Plans

Life changes—so should your financial strategies. Revisit your goals annually, review your investment portfolio, and adjust insurance coverage and estate plans.

📈 Build a Powerful Financial Future—One Decade at a Time

The journey to financial freedom isn’t about drastic overnight changes—it’s about consistent, informed actions. By following these women financial tips customized to each life stage, you’re taking control of your financial future and setting the foundation for a secure, independent, and abundant life. From smart money management tips for women in their 30s to legacy-building in your 50s, every step counts.

Your wealth is your power—build it, own it, protect it.

Related Posts you may like

Well Explain About Women Financial Tips. Such a Very Useful information 👌